Why A Financial Empowerment Platform

Motivation

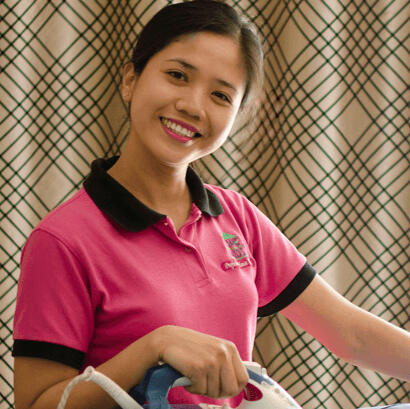

Millions of workers are hired by employment agencies to migrate to the Middle East and take on low-income service jobs. Due to lack of financial opportunity in their home countries, these workers migrate to the Middle East and often send large portions of their earnings back to their home country to provide financial support to their families. Unfortunately, they face significant vulnerabilities including debt traps, recruitment expenses, lack of financial literacy, and limited knowledge of safe banking options. Many domestic workers—particularly live-in maids—lack formal financial education, resulting in instability both for themselves and their dependents back home.We strongly believe this is a problem with opportunity for widespread impact both across and beyond the Middle East. For our capstone project, we are focused specifically on the population of ~750,000 domestic workers in the UAE, specifically those who migrated from the Philippines and are working as live-in maids.

A Teammate for Every Worker

Our Vision

Our platform vision is to provide personalized tools that build trust, foster growth, enable financial empowerment, and strengthen community connections.• Digital Identity & Credit Score: Build trust with verified digital profiles to support safe banking and employment opportunities.• Coaching & Education: Personalized financial literacy and savings guidance tailored to migrant workers' unique needs.• Microfinance Matching: Connect workers with donors and microfinance opportunities to build stability and independence.• Community Engagement: Foster mentorship, peer support, and connections through community-driven programs.

What We Built

Berkeley Capstone Project

For our MVP, we took a focused approach to initially build for Filipino Maids in the UAE.Our field research, including a survey of 26 maids in the UAE, showed that financial literacy was a key priority for this user base. We designed and built a Financial Coach, tackling the Coaching & Education element of our vision for the full Aspaira platform.Leveraging demographic and financial information from user profile inputs, our user facing application uses Agentic AI and Gen AI techniques to walk users through dynamic, personalized financial education sessions.We also built a Multi-Judge AI Framework which scores conversations across criteria enabling robust, unbiased evaluation. These insights are then used to continuously improve the user facing application.

Demo of What We Built:

Tech Stack:

📱Steamlit UI

⚡FastAPI Backend

🛢️Data in DynamoDB

🧠Dify LLM Orchestration

☁️ Global AWS DeploymentGithub RepoFinal Presentation Slides

The Voice Of Our Users

Testimonials

AspAIra Feedback Form

Contact Us

We look forward to hearing from you!

Thank you

We thank maids.cc agency for initial feedback, the domestic workers who participated in our field research, Berkeley MIDS faculty and mentors, and Dify and AWS for enabling our rapid prototyping and deployment.